Living with Hearing Loss

How Hearing Accessible Hotel Rooms Are Cheaper: A Guide

A surprising revelation awaits as we uncover why hearing accessible hotel rooms offer a more affordable option.

Have you ever pondered the reason why rooms in hotels that are accessible to individuals with hearing impairments are offered at reduced rates?

The reasons behind the affordability of these rooms might surprise you.

By understanding the factors that contribute to their cost-effectiveness, travelers can make informed decisions that benefit both their budget and inclusivity.

Let's explore the intricacies of how these accommodations manage to offer a more economical option without compromising on accessibility standards.

Key Takeaways

- Efficient layouts and smart material choices drive down construction and maintenance costs.

- Design features balance affordability with quality and comfort for ADA rooms.

- Compliance with regulations and standards impacts pricing decisions for accessibility features.

- Lower demand for accessible rooms leads to competitive pricing strategies.

Demand for Accessible Rooms

Accessible hotel rooms often go unnoticed by many travelers, impacting their demand and affordability. The smaller segment of guests requiring accessibility contributes to accessible rooms being more affordable compared to standard rooms. This lower demand for accessible rooms leads to hotels implementing competitive pricing strategies to attract more guests.

Hotels strive to prevent loss of revenue from vacant accessible rooms by offering them at a more competitive price point. The design differences in accessible rooms, such as fewer features and smaller bathrooms, also play a significant role in their lower cost. These design variances not only cater to the specific needs of guests requiring accessibility but also contribute to the overall affordability of these rooms.

Design Impact on Pricing

When considering the design impact on pricing of accessible hotel rooms, it's crucial to understand the balance between cost-efficient room design and budget-friendly accessibility features.

The choices made in room layout, furniture selection, and compliance standards can significantly influence the overall pricing strategy.

Cost-Efficient Room Design

In designing cost-efficient hotel rooms, we prioritize elements that enhance affordability without compromising quality or comfort. When creating ADA rooms with cost savings in mind, we focus on specific design features to keep prices reasonable:

- Efficient Layouts: Simplifying room layouts and maximizing space utilization helps reduce construction and maintenance costs.

- Standardized Fixtures: Using standardized fixtures and fittings not only ensures compliance with accessibility regulations but also minimizes expenses.

- Smart Material Choices: Opting for durable, low-maintenance materials in the design of ADA rooms can lead to long-term cost savings while maintaining a high standard of quality.

Budget-Friendly Accessibility Features

To navigate the balance between affordability and quality in designing cost-efficient hotel rooms, our focus shifts to exploring the impact of budget-friendly accessibility features on pricing.

When it comes to accessible hotel rooms, incorporating design elements like open floor space and fewer amenities can significantly lower the overall cost. Compliance standards play a crucial role in dictating the design options available, affecting the pricing of these rooms. Features such as smaller bathrooms and limitations on furniture pieces help keep the costs of accessible rooms down while still ensuring functionality and comfort for guests.

Despite the need to meet accessibility standards, the emphasis remains on providing a pleasant and inclusive stay for all guests at a reasonable price point.

Compliance Standards Influence Costs

Meeting compliance standards for hearing accessible hotel rooms can significantly impact costs due to the need for specific features and technology. Visual alarms, doorbell alerts, TTY devices, bed shakers, and vibrating alarm clocks all contribute to the pricing of these accommodations.

Additionally, ongoing staff training and maintenance to ensure ADA guidelines are met can further influence pricing decisions.

Cost of Modifications

Navigating the world of compliance standards in hearing accessible hotel rooms can significantly impact the overall cost of modifications, particularly due to the specific requirements for visual alarms, accessible telephones, and notification devices. When considering the cost of modifications for hearing accessible rooms, here are key factors to keep in mind:

- Specialized Equipment: The need for specialized equipment like visual alert systems and vibrating devices can increase the overall cost of modifications.

- Labor and Materials: Installation of hearing accessible features such as visual alarms and notification devices may require additional labor and materials, influencing pricing.

- ADA Compliance: Compliance with ADA regulations for hearing accessible rooms involves specific design elements and technology, adding to the overall cost of room modifications.

Impact on Pricing

Considering the specific requirements for visual alarms, notification devices, and accessibility features in compliance standards for hearing accessible hotel rooms, the impact on pricing becomes a critical factor to address during modifications.

Compliance with ADA regulations necessitates the installation of visual fire alarms, vibrating bed alert systems, and hearing aid compatible telephones, all of which can contribute to the pricing structure.

Ensuring that hearing accessible rooms include visual notification devices, closed captioning services, and TTY telecommunication devices may incur additional costs due to the need for specialized equipment and technology.

Incorporating features such as flashing alarm clocks, bed shakers, and visual alert systems in these rooms not only enhances accessibility but also influences the overall pricing of the accommodations.

Balancing compliance standards with affordability is essential when considering the pricing structure for hearing accessible hotel rooms.

Accessible Vs. Non-Accessible Room Pricing

When comparing the pricing of accessible and non-accessible hotel rooms, it's important to consider factors such as demand, design constraints, and amenities that contribute to the rate differences.

Key Points to Understand:

- Lower Demand and Design Constraints: Accessible rooms are often cheaper, typically priced 10-15% lower than non-accessible rooms due to lower demand and design limitations.

- Influence of Square Footage and Compliance Standards: The price difference between accessible and non-accessible rooms is influenced by factors like square footage and compliance standards, impacting the overall cost for guests.

- Amenities and Features Discrepancy: Non-accessible rooms tend to have higher rates because they often boast more amenities and features compared to accessible rooms. Competitive pricing strategies play a role in making accessible room pricing more affordable for budget-minded travelers.

Understanding these nuances can help guests make informed decisions when selecting between accessible and non-accessible hotel rooms based on their individual needs and preferences.

Economic Benefits of Accessibility

To further explore the economic advantages of accessibility in the hospitality industry, it's essential to understand how offering hearing accessible hotel rooms can lead to cost-effective solutions for both guests and hotel operators. Competitive pricing strategies play a crucial role in making these rooms more affordable for guests, as the lower demand for hearing accessible rooms allows hotels to offer them at reduced rates.

Additionally, the limited amenities in these rooms help in keeping costs lower for guests, contributing to overall cost savings. Moreover, the reduced maintenance costs associated with hearing accessible features further enhance their affordability. By implementing these cost-effective measures, hotels can attract a wider range of guests, increase their occupancy rates, and ultimately boost their revenue.

Embracing accessibility not only benefits guests with specific needs but also presents a smart business strategy for hotels looking to enhance their competitive edge in the market.

Booking Considerations for Cost-Efficiency

In planning your stay, prioritize cost-efficiency by carefully considering booking options for hearing accessible hotel rooms that align with your budget and needs. When aiming for lower pricing, keep these considerations in mind:

- Flexible Dates: Check for price discrepancies based on weekdays versus weekends or during off-peak seasons. Adjusting your stay dates can help you secure better rates for hearing accessible rooms.

- Direct Booking: Contact the hotel directly to inquire about any special promotions or discounts for hearing accessible rooms. Sometimes, booking directly with the hotel can lead to cost savings compared to third-party booking websites.

- Membership Discounts: Utilize any memberships or loyalty programs you're part of to access exclusive deals on hearing accessible accommodations. Loyalty points or member discounts can significantly reduce the overall cost of your stay.

Maintenance Cost Variances

Maintenance cost variances in hearing accessible hotel rooms are notably lower compared to traditional rooms due to their simplified design features. Unlike traditional rooms that may require specialized equipment like visual alarms or vibrating beds, hearing accessible rooms have simpler design elements, leading to lower maintenance expenses.

The reduced need for advanced technology in hearing accessible rooms results in fewer upkeep requirements, ultimately translating to decreased maintenance costs over time. By eliminating complex features that often require frequent maintenance, hearing accessible rooms offer a more straightforward and cost-effective option for hotels to manage.

This difference in maintenance cost variances not only benefits the hotel's bottom line but also contributes to the overall affordability of these rooms for guests. As a result, choosing hearing accessible rooms can be a practical and economical choice for both hotel owners and individuals seeking comfortable accommodation options.

Amenities and Price Point Analysis

With the focus shifting to Amenities and Price Point Analysis, it becomes evident that hearing accessible hotel rooms offer a cost-effective and practical choice for travelers seeking essential amenities tailored to their auditory needs. When comparing the price differentials between hearing accessible and standard rooms, it's apparent that the former presents a budget-friendly option. Here's a breakdown to help you understand why hearing accessible rooms are a great choice:

- Cost Savings: By focusing on essential amenities like visual alarms and TTY devices, hearing accessible rooms can be offered at a lower price point compared to rooms with more specialized features.

- Affordability: Price differentials typically range from 10-15%, making hearing accessible rooms a cost-effective option for budget-conscious travelers looking for quality accommodations.

- Discounted Rates: Hotels may provide discounted rates for hearing accessible rooms to ensure availability for guests with specific needs, further enhancing the affordability of these rooms.

Accessibility and Occupancy Rates

Limited availability of hearing accessible rooms in hotels often influences both their accessibility and occupancy rates. Hotels typically assign a smaller portion of their rooms to meet the needs of guests requiring hearing accessibility. This allocation directly impacts the pricing of these particular rooms.

Due to the lower demand for hearing accessible rooms, hotels often offer competitive pricing to attract guests, leading to lower occupancy rates for these specific accommodations. The reduced popularity of these rooms results in more rooms being vacant compared to standard rooms, affecting the overall occupancy rates of the hotel.

Despite the lower occupancy rates, the pricing of hearing accessible rooms tends to be more affordable due to limited features and amenities in these rooms. Additionally, following accessibility standards might restrict design options for these rooms, influencing their pricing structure. Lower maintenance costs for hearing accessible rooms also contribute to their cost-effectiveness, making them a budget-friendly option for guests seeking accessibility without compromising on quality.

Frequently Asked Questions

Why Are Hearing Accessible Rooms Cheaper?

Hearing accessible rooms are cheaper due to lower demand. They often feature fewer specialized amenities, keeping costs down.

These rooms may not require extensive modifications, contributing to their cost-effectiveness. Reduced demand and simpler design modifications help maintain affordability.

Can Normal People Book Accessible Hotel Rooms?

Yes, normal people can book accessible hotel rooms, but it's considerate to prioritize them for disabled guests. When reserving, it's essential to think about the needs of others. Research nearby accessible facilities and request these accommodations when booking.

Accessible rooms may be smaller with fewer amenities, impacting pricing. It's important to book online and ensure a comfortable stay for all guests, showing empathy and inclusivity towards those with disabilities.

What Does Hearing Accessible Mean for a Hotel Room?

Hearing accessible hotel rooms are equipped with features like visual alarms, vibrating alarm clocks, and communication devices for guests with hearing impairments. These rooms ensure safety and communication for individuals who rely on visual cues.

Examples of accommodations may include TDDs, visual notification devices, and captioned televisions, meeting ADA requirements. The specialized features in these rooms cater to the needs of those with hearing disabilities, ensuring a comfortable stay for all guests.

Are ADA Hotel Rooms Better?

Yes, ADA hotel rooms are better for individuals with disabilities because they provide essential accessibility features like wider doorways and grab bars. These rooms offer similar amenities to regular rooms, ensuring comfort while prioritizing accessibility needs.

Conclusion

As budget-conscious travelers, we can appreciate the cost savings that come with booking a hearing accessible hotel room. By understanding the factors that contribute to their affordability, we can make informed decisions that not only save us money but also ensure that these important accommodations remain available for those who need them.

So next time you're planning a trip, consider the economic benefits of accessibility and book a room that meets your needs without breaking the bank.

Jamie is one of the creative forces behind the words that resonate with our audience at Deaf Vibes. With a passion for storytelling and advocacy, Jamie delves into topics that matter deeply to the deaf and hard-of-hearing community. Jamie’s articles are crafted with empathy, insight, and a commitment to positive change, from exploring the latest advancements in hearing technologies to shedding light on the everyday challenges and victories of those within the community. Jamie believes in the power of shared stories to inspire action, foster understanding, and create a more inclusive world for everyone.

Living with Hearing Loss

Batteries That Cannot Be Recycled: A How-To Guide

Uncover the secrets of handling unrecyclable batteries – discover innovative solutions for a more sustainable future.

As we navigate the landscape of battery disposal, we often encounter roadblocks in the form of batteries that seem to be the dead ends of recycling. How can we responsibly handle these unrecyclable powerhouses of our devices?

Let's shed light on strategies and insights that could offer a pathway towards a more sustainable approach to dealing with batteries that pose challenges in the recycling realm.

Key Takeaways

- Proper handling and disposal prevent environmental harm.

- Store and transport unrecyclable batteries safely.

- Adhere to local regulations for proper disposal.

- Repurpose non-recyclable batteries for low-drain devices.

Common Non-Recyclable Battery Types

When it comes to common non-recyclable battery types, identifying damaged or leaking batteries is crucial due to the safety risks they pose. Non-recyclable batteries can include those with mixed chemistries, like combining lithium and alkaline batteries, which can't be recycled together. These mixed chemistry batteries not only complicate the recycling process but can also lead to safety hazards if they leak or malfunction.

Moreover, it's essential to be cautious with non-standard batteries, such as homemade or modified batteries, as these aren't accepted for recycling due to safety concerns and the unknown chemistry involved. When handling electronic devices that contain batteries, it's important to recycle them separately from the batteries to prevent any potential risks.

Environmental Impact of Unrecycled Batteries

Unrecycled batteries pose a significant threat to the environment by contaminating groundwater and ecosystems with toxic chemicals such as mercury, lead, cadmium, and nickel. Improper disposal of batteries can lead to hazardous waste seeping into the ground and water sources, causing long-lasting damage to the ecosystem. The environmental impact of unrecycled batteries goes beyond contamination and extends to the risk of fires and explosions due to the reactive materials present in these batteries.

3 Key Points:

- Proper Disposal Methods: Ensuring batteries are disposed of correctly is crucial to prevent the release of toxic substances that can harm the environment.

- Recycling Initiatives: Recycling batteries reduces the amount of hazardous waste that ends up in landfills, contributing to a cleaner environment.

- Preventing Groundwater Contamination: By recycling batteries, we can significantly reduce the risk of groundwater contamination, protecting both human health and ecosystems.

Proper Storage of Unrecyclable Batteries

To ensure the safe storage of unrecyclable batteries, it is essential to follow proper guidelines such as storing them in a cool, dry place away from direct sunlight. Keeping unrecyclable batteries in their original packaging or separate compartments can prevent short-circuiting. Placing these batteries in a plastic container will help contain any leaks or spills. It's crucial to avoid mixing different types of unrecyclable batteries to prevent potential chemical reactions. Lastly, labeling the storage container clearly as 'Used Batteries – Do Not Recycle' is important for safety and proper disposal.

| Storage Guidelines for Unrecyclable Batteries |

|---|

| Store in a cool, dry place away from sunlight |

| Keep in original packaging or separate compartments to prevent short-circuiting |

| Place in a plastic container to contain leaks |

| Avoid mixing different types to prevent chemical reactions |

| Label container as 'Used Batteries – Do Not Recycle' |

Local Regulations on Battery Disposal

Local regulations on battery disposal can significantly impact how individuals must handle and discard their used batteries. It's crucial to understand the battery disposal regulations in your locality to avoid improper battery disposal and prevent environmental harm. Here are some key points to consider:

- Variation in Regulations: Local guidelines on battery disposal vary by state and city. Some areas may have specific rules for disposing of different types of batteries, such as alkaline, lithium-ion, or lead-acid batteries.

- Restrictions on Disposal Methods: Certain locations may prohibit throwing batteries in the trash due to environmental concerns. To comply with these regulations, individuals may need to use designated drop-off locations or recycling centers for their used batteries.

- Consult Local Authorities: It's essential to check with local waste management authorities to understand the specific guidelines on battery disposal in your area. By following these regulations, you can contribute to the proper management of battery waste and protect the environment.

Safe Handling and Transport Guidelines

When dealing with batteries that can't be recycled, it's crucial to prioritize safety measures such as wearing gloves to shield against corrosive materials.

Securely transporting these batteries in a non-conductive container is essential to prevent leaks or short-circuiting.

Additionally, storing non-recyclable batteries away from heat sources and flammable items is vital to minimize fire risks.

Handling Safety Measures

Regularly wearing gloves when handling non-recyclable batteries is crucial to prevent direct exposure to toxic chemicals. To ensure safe handling of these batteries, follow these safety measures:

- Use a Non-Conductive Container: Place non-recyclable batteries in a non-conductive, secure container to prevent any accidental discharge or short-circuiting during transport.

- Avoid Mixing: It's important not to mix non-recyclable batteries with recyclable ones to avoid contamination and potential hazards.

- Proper Storage: Store non-recyclable batteries in a cool, dry place away from flammable materials to reduce the risk of fire or other safety incidents.

Proper Transportation Methods

To ensure the safe handling and transport of non-recyclable batteries, it's essential to follow proper guidelines and precautions to minimize potential risks and hazards.

Always transport batteries in secure containers or their original packaging to prevent short-circuiting or leaks. When dealing with damaged batteries, use caution to avoid skin contact or inhaling harmful chemicals.

Secure batteries during transport to prevent movement or damage that could lead to safety hazards. It's crucial to keep batteries away from heat sources and flammable materials to reduce the risk of fire or explosion while in transit.

Different types of batteries, like lithium-ion or lead-acid, may have specific transportation guidelines that need to be followed for safe handling and compliance with regulations.

Storage Precautions to Take

For the safe storage and transport of non-recyclable batteries, it's crucial to segregate them from recyclable batteries to prevent potential contamination risks.

Here are three essential precautions to take when handling non-recyclable batteries:

- Store Separately: Keep non-recyclable batteries in a designated area away from recyclable ones to avoid any cross-contamination.

- Cool and Dry Storage: Store non-recyclable batteries in a cool, dry place, shielded from direct sunlight to maintain their integrity.

- Secure Transport: When moving non-recyclable batteries, use their original packaging or a secure container to prevent damage and potential leakage during transportation.

Following these storage precautions won't only ensure the safety of handling non-recyclable batteries but also help in minimizing environmental risks associated with their disposal.

Alternative Uses for Non-Recyclable Batteries

Consider repurposing non-recyclable batteries for low-drain devices to prolong their functionality and minimize waste. Instead of tossing them out immediately, give these batteries a second life by using them in gadgets that do not require high power output. Here are some practical ways to upcycle non-recyclable batteries:

| Device | Examples |

|---|---|

| Remote Controls | TV remotes, air conditioner remotes |

| Wall Clocks | Analog or digital clocks |

| LED Candles & Decorative Lights | Mood lighting, holiday decorations |

| Children's Toys | Small toys, toy cars, dolls |

| Emergency Flashlights | Power outage lights, camping lanterns |

| DIY Projects | Small robotics, crafts, educational kits |

Disposal Options for Non-Recyclable Batteries

Repurposing non-recyclable batteries for low-drain devices can extend their functionality and reduce waste, but when these batteries reach the end of their usable life, it's crucial to consider proper disposal options to prevent environmental harm.

Here are some disposal options for non-recyclable batteries based on local regulations:

- Trash Disposal: In many areas, non-recyclable batteries such as non-rechargeable alkaline batteries can be safely disposed of in the regular trash. Following local guidelines for trash disposal ensures that these batteries are handled properly.

- Special Collection Programs: Some localities offer special collection programs for non-recyclable batteries. These programs may provide designated drop-off locations or collection events where you can safely dispose of these batteries.

- Hazardous Waste Facilities: Non-recyclable batteries can sometimes be disposed of at hazardous waste facilities. These facilities are equipped to handle various types of hazardous materials, ensuring proper disposal according to regulations.

It's crucial not to mix non-recyclable batteries with recyclable ones during disposal to prevent contamination and environmental harm. Remember to seal the batteries properly before disposal to avoid leaks or damage.

Future Innovations in Battery Recycling

Innovative advancements in battery recycling are revolutionizing the way we handle and recover valuable materials from used batteries. Advanced sorting technologies are being developed to efficiently separate different battery types, leading to increased recycling rates. These advancements aim to recover essential materials such as cobalt and lithium, reducing the reliance on mining for these resources. Research in battery recycling is also focused on creating more sustainable processes to manage the growing volume of used batteries effectively. By exploring improved methods for dismantling and processing batteries, we can minimize the environmental impact of their disposal. Collaboration between industry, government, and research institutions plays a crucial role in driving these advancements in battery recycling technology.

| Benefits of Future Battery Recycling Innovations |

|---|

| Efficient sorting of battery types |

| Increased recycling rates |

| Recovery of valuable materials like cobalt and lithium |

| Sustainable processes for handling used batteries |

| Reduced environmental impact of battery disposal |

Frequently Asked Questions

What Batteries Cannot Be Recycled?

Sure thing!

Some batteries that can't be recycled include lithium-ion batteries, lead-acid batteries, and non-rechargeable alkaline batteries like AA, AAA, and 9-volt batteries. It's crucial to dispose of these batteries properly to avoid environmental harm.

When dealing with mixed or damaged batteries, caution is advised. Check with local recycling facilities or hazardous waste disposal sites for guidance on how to handle batteries that can't be recycled.

Can All Types of Batteries Be Recycled and How?

Yes, not all types of batteries can be recycled. Understanding which ones can't be recycled is crucial for proper disposal.

Lithium-ion batteries, for instance, pose challenges due to safety concerns and the need for specialized facilities.

Button-cell batteries contain toxic materials like mercury and must be recycled correctly.

Lead-acid batteries used in vehicles require specific processes for recovering valuable materials.

Knowing these distinctions helps in making informed decisions to protect the environment.

What Can You Do With a Broken Lithium-Ion Battery?

When facing a broken lithium-ion battery, it's imperative to act cautiously. Never attempt DIY repairs due to the risks of fire or explosion. Instead, contact professionals at a recycling center or hazardous waste disposal facility for safe handling.

Avoid exposing the damaged battery to extreme conditions like heat. Proper disposal is crucial to prevent environmental harm and ensure safety. Let's prioritize responsible actions to mitigate potential hazards effectively.

How Do You Dispose of Bulging Lithium Batteries?

When disposing of bulging lithium batteries, it's crucial to handle them with care due to potential safety risks. Avoid puncturing or tampering with them to prevent fires or explosions.

Store these batteries in a cool, dry place away from flammable materials.

Always seek professional help for safe disposal, reaching out to local waste management or specialized recycling facilities for guidance. Bulging lithium batteries may indicate internal damage, necessitating expert handling to ensure safety.

Conclusion

In conclusion, it's crucial for us to properly dispose of batteries that can't be recycled to protect our environment.

Did you know that approximately 3 billion batteries are thrown away each year in the United States alone?

By following the guidelines in this guide, we can all play a part in reducing the environmental impact of unrecycled batteries and work towards a more sustainable future.

Let's do our part and make a difference!

Jamie is one of the creative forces behind the words that resonate with our audience at Deaf Vibes. With a passion for storytelling and advocacy, Jamie delves into topics that matter deeply to the deaf and hard-of-hearing community. Jamie’s articles are crafted with empathy, insight, and a commitment to positive change, from exploring the latest advancements in hearing technologies to shedding light on the everyday challenges and victories of those within the community. Jamie believes in the power of shared stories to inspire action, foster understanding, and create a more inclusive world for everyone.

Living with Hearing Loss

Top Deaf Meetups Near Me You Can't Miss

Uncover the vibrant world of Deaf culture and connections at top meetups near you, where every gesture tells a story worth exploring.

Imagine a world where hands speak volumes, and silence is a language of its own. In the realm of Deaf meetups, connections go beyond words, creating a tapestry of shared experiences that resonate with authenticity.

As we navigate the landscape of upcoming events tailored for the Deaf community, one can't help but feel drawn to the vibrancy and inclusivity these gatherings offer. From engaging in enriching conversations to exploring new avenues of expression, the allure of these meetups is undeniable.

Join us as we uncover the hidden gems of Deaf culture waiting to be discovered.

Key Takeaways

- Engage in immersive ASL practice and skill enhancement through conversations, games, and networking.

- Explore diverse artistic expressions and connect with talented deaf artists in a supportive environment.

- Foster wellness and community building through inclusive yoga, meditation, picnics, and BBQs.

- Celebrate Deaf culture, storytelling, and social connections through engaging events like game nights and artistic showcases.

Sign Language Conversation Practice

Sign language conversation practice meetups offer a welcoming space for individuals to enhance their ASL skills through engaging interactions with fluent signers and fellow learners. These gatherings provide a valuable opportunity for those learning ASL to immerse themselves in a supportive environment that fosters growth and confidence in communication. By participating in these Deaf Events, individuals can engage in conversations, storytelling, and discussions solely using American Sign Language, helping them to build fluency and proficiency.

Moreover, these meetups often incorporate fun activities like games, storytelling sessions, and group discussions, making the learning process enjoyable and interactive. Through these engaging experiences, participants not only improve their ASL skills but also form connections within the Deaf community, creating a sense of belonging and camaraderie. Joining these sign language conversation practice meetups can be a transformative experience, enhancing both communication abilities and social connections within the Deaf community.

Deaf Coffee Chat and Networking

How do Deaf Coffee Chat events create a welcoming space for individuals to socialize and network within the deaf community? Deaf Coffee Chat events offer a supportive environment for practicing American Sign Language (ASL) skills and connecting with others who are part of the deaf community.

Here are three ways these meetups facilitate networking and socializing:

- Comfortable Settings: These events often take place in local coffee shops or cafes, providing a relaxed atmosphere for attendees to engage in conversations using sign language.

- Community Building Activities: Deaf Coffee Chats may include icebreakers, games, and discussions that help foster a sense of community and camaraderie among participants.

- Friendship and Support: Attending these gatherings can help individuals build friendships, share experiences, and feel a sense of belonging within the deaf community, creating a platform for networking and mutual support.

Deaf Coffee Chat events serve as valuable opportunities for deaf individuals to come together, socialize, practice ASL, and forge meaningful connections within their community.

ASL Storytelling Night

ASL Storytelling Night events offer a captivating platform for deaf storytellers to share their narratives in American Sign Language, celebrating the richness and creativity of Deaf culture. These gatherings provide a unique opportunity for individuals to immerse themselves in the visual language and narrative traditions of the Deaf community.

Participants can experience the beauty and expressiveness of ASL storytelling in a vibrant and engaging setting, where ASL is celebrated as a powerful storytelling medium. Through these events, the Deaf culture's depth and diversity are showcased, fostering a sense of belonging and appreciation among attendees.

ASL Storytelling Nights play a crucial role in promoting deaf education by highlighting the importance of visual communication and storytelling for Deaf children and learners. By attending these storytelling events, individuals can learn, connect, and be inspired by the creative ways in which ASL is used to convey stories and emotions within the Deaf community.

Deaf Yoga and Meditation Sessions

In our community, Deaf Yoga and Meditation Sessions offer a welcoming space for individuals with hearing impairments to engage in mindful practices tailored to their needs. These sessions cater to the deaf and hard of hearing community, providing a peaceful and accessible environment for participants to practice mindfulness and relaxation techniques. Here's what makes these sessions stand out:

- Inclusive Classes: Certified instructors fluent in sign language lead the classes, ensuring clear communication and understanding for all attendees.

- Physical and Mental Wellness: Participants can benefit from the physical and mental wellness aspects of yoga and meditation in a supportive and welcoming setting.

- Community Building: Deaf Yoga and Meditation Sessions promote holistic well-being and foster a sense of community among individuals with hearing impairments.

If you're interested in getting involved and exploring the benefits of yoga and meditation in a space designed for the deaf and hard of hearing, these sessions offer a unique opportunity for growth and relaxation.

Lip-reading Workshop for Beginners

Enhancing communication skills through lip-reading workshops is a valuable opportunity for beginners seeking to improve their understanding of spoken language visually. These workshops play a crucial role in assisting individuals with hearing loss by providing techniques to decipher speech through lip movements.

For beginners, it can be hard initially to grasp all the nuances, but with practice and guidance, recognizing sounds, words, and phrases becomes more manageable. Lip-reading workshops are an essential part of learning to communicate effectively, especially for those who use hearing aids or have varying degrees of hearing loss.

Practical exercises and strategies offered in these workshops empower participants to enhance their communication abilities and feel more confident in daily interactions. By honing these skills, beginners can navigate conversations with greater ease and bridge the gap between spoken language and visual comprehension.

Deaf Movie Night Out

We're excited to shed light on the criteria for movie selections at Deaf Movie Night Out events, ensuring deaf audiences are engaged with films that resonate with their experiences.

We'll explore the importance of venue accessibility, highlighting how these meetups prioritize creating a welcoming space for all participants.

Additionally, we'll delve into the dynamics of group interactions during these movie nights, showcasing how they foster connections and shared experiences within the deaf community.

Movie Selection Criteria

Considering the diverse interests and preferences within our community, Deaf Movie Night Out carefully selects films that offer closed captioning to ensure an inclusive and enjoyable experience for all attendees. Our movie selection criteria focus on catering to the needs of deaf and hard of hearing individuals while also embracing a variety of genres and styles.

Here's how we choose our movies:

- Accessibility: Films must have closed captioning available.

- Inclusivity: Selections consider visual storytelling to accommodate diverse preferences.

- Engagement: Movies are chosen to provide an enjoyable experience for all attendees.

Venue and Accessibility

At Deaf Movie Night Out, our venues prioritize accessibility by offering closed captioning for all movie screenings. We understand the importance of providing a welcoming and inclusive space for all movie enthusiasts.

In addition to closed captioning, movie theaters also provide assistive listening devices for our hearing-impaired guests. Some venues go above and beyond by offering Fidelio and Hearing Loop systems, enhancing the movie-watching experience for everyone.

Deaf-friendly theaters like AMC and Landmark are leading the way in catering to diverse accessibility needs. Performances at theaters such as Alley Theatre ensure that all individuals, regardless of their hearing abilities, can enjoy the magic of movies in a supportive and inclusive environment.

Group Interaction Dynamics

As we come together at Deaf Movie Night Out, the group interaction dynamics create a vibrant and engaging space for deaf individuals to connect over shared movie experiences.

Group Interaction Dynamics at Deaf Movie Night Out:

- Active Participation: Attendees are encouraged to engage in discussions and activities related to the films shown.

- Shared Experiences: The inclusive environment fosters the sharing of thoughts, emotions, and reactions to the movies watched.

- Community Building: Through sign language interpretation, captioned films, and a welcoming atmosphere, friendships are formed, and a sense of community is cultivated.

At Deaf Movie Night Out, the mix of entertainment and social interaction enhances the overall experience, making it a must-attend event for those seeking connection and cultural appreciation.

ASL Book Club Meetings

Join us at the ASL Book Club meetings to delve into captivating literature discussions in American Sign Language! These gatherings provide a unique space for deaf individuals to come together and explore the world of books through the beauty of ASL.

Participants engage in interactive conversations about various literary works, sharing their thoughts, interpretations, and emotions in a visually rich and expressive manner.

ASL Book Clubs offer more than just a reading group; they create a sense of community where members can connect, learn from one another, and appreciate the diversity of deaf culture. From deaf-related literature to works by deaf authors or popular books translated into ASL, the reading selections cater to a wide range of interests, ensuring there's something for everyone to enjoy and discuss.

Deaf Technology Fun Fair

Exploring the vibrant intersection of technology and accessibility, the Deaf Technology Fun Fair offers a captivating showcase of cutting-edge innovations tailored to the deaf and hard of hearing community. At this event, attendees immerse themselves in a world of technological advancements designed to enhance communication and connectivity.

Here's what you can expect at the Deaf Technology Fun Fair:

- Innovative Devices: Explore the latest advancements such as video relay services, text-to-911 options, and smartphone apps specifically crafted to improve communication accessibility for the deaf and hard of hearing.

- Hands-On Demonstrations: Engage in interactive workshops and experience firsthand demonstrations of how these cutting-edge tools work, empowering attendees with practical knowledge and skills.

- Networking Opportunities: Connect with experts, developers, and advocates in the field of deaf technology. This fair provides a platform for learning, networking, and staying updated on the technological solutions available to enhance daily communication needs. Join us to discover how these tools can revolutionize your communication experience!

Sign Language Poetry Slam

Sign Language Poetry Slam events are vibrant platforms where poets, both deaf and hearing, express their emotions and stories through visually captivating sign language performances.

These gatherings not only showcase creative expression through ASL but also foster community bonding through the shared love of poetry.

Creative Expression Through ASL

Engage with the vibrant world of artistic expression through American Sign Language at captivating Sign Language Poetry Slam events. Sign Language Poetry Slams offer a unique platform for deaf individuals to unleash their creativity and share their stories through visually stunning performances.

Here's why these events are a must-experience:

- Artistic Showcase: Participants bring emotions, stories, and experiences to life through the beauty of sign language, captivating the audience with their creativity.

- Community Connection: Deaf poets and storytellers connect with the community, fostering a sense of belonging and understanding through shared experiences.

- Cultural Celebration: These events promote cultural appreciation, linguistic diversity, and inclusivity within the deaf community, showcasing the power of sign language as a form of artistic expression.

Community Bonding Through Poetry

Gathering at Sign Language Poetry Slam events allows individuals, both deaf and hearing, to form strong bonds through the shared appreciation of poetry in American Sign Language. These events serve as platforms for creative expression and community building. Through visually captivating performances, participants convey deep emotions and intricate narratives using hand movements and facial expressions. Attendees immerse themselves in the beauty and artistry of signed poetry, fostering inclusivity and understanding among diverse audiences. To highlight the impact of Sign Language Poetry Slams, consider the following:

| Benefits of Sign Language Poetry Slam Events |

|---|

| Fosters community bonding |

| Encourages creative expression |

| Promotes linguistic appreciation |

Celebrating Deaf Culture

Celebrating the vibrant richness of Deaf culture through the expressive artistry of poetry in American Sign Language fosters a profound sense of connection and understanding among participants. Sign Language Poetry Slam events offer a platform for deaf poets to showcase their creativity and highlight the beauty of sign language communication.

Attendees immerse themselves in the power of visual storytelling and linguistic expression, experiencing a vibrant and inclusive environment that celebrates diversity. Through these poetry performances, cultural awareness, language appreciation, and community connection within the deaf and hearing-impaired community are promoted.

Join us in celebrating the art, culture, and language of the Deaf community at these enriching Sign Language Poetry Slam events.

Deaf Karaoke Night

Immerse yourself in the vibrant world of Deaf Karaoke Nights, where music becomes a bridge connecting the deaf community through shared talents and joyful expression. These inclusive and accessible music events offer a platform for deaf individuals to showcase their singing skills and have a great time. Participants can sing along with lyrics displayed on screens or through sign language interpreters, ensuring everyone can join in the fun.

Deaf Karaoke Nights go beyond just singing; they create a supportive and engaging environment for socializing and connecting within the deaf community. It's a place where cultural diversity is celebrated, and the joy of music is shared by all. Whether you're a seasoned performer or just looking to have a good time, these events welcome everyone to come together, enjoy music, and experience the beauty of deaf culture through the universal language of song.

ASL Cooking Class Gatherings

Exploring the vibrant intersection of sign language and culinary arts, ASL cooking class gatherings offer a unique blend of language learning and hands-on cooking experiences. These meetups provide a supportive environment for individuals to enhance their ASL communication skills through interactive cooking sessions. Participants can engage in hands-on cooking experiences while practicing American Sign Language in a social setting, creating a dynamic learning environment.

Key Highlights:

- Language Learning: ASL cooking classes offer a practical way to learn sign language while honing culinary skills, combining education with creativity.

- Community Building: Attendees bond over a shared love for cooking and sign language, fostering a sense of belonging and camaraderie within the group.

- Cultural Exchange: These gatherings promote inclusivity and understanding between deaf and hearing individuals, creating a space for fun, education, and connection through shared passions.

Deaf Artists Exhibition and Meetup

Let's celebrate the vibrant creativity of deaf artists at the Deaf Artists Exhibition and Meetup.

This event is a fantastic opportunity to admire a diverse range of artistic expressions, from paintings to sculptures and photography.

Join us to connect with talented creatives, learn about their inspirations, and show your support for the deaf artistic community.

Artistic Talent Showcase

The Artistic Talent Showcase offers a vibrant platform for deaf artists to showcase their creative works and connect with both fellow artists and the community. Attendees can immerse themselves in a world of diverse artistic expressions and gain insight into the unique perspectives of deaf artists.

Here's why the showcase is a must-visit:

- Exhibition of Creativity: Experience a range of artworks spanning various mediums, from paintings to sculptures, each telling a story through the lens of deaf artists.

- Community Connection: Engage with a supportive community that values and celebrates the talents of deaf artists, fostering a sense of belonging and appreciation.

- Celebration of Diversity: Embrace the richness of deaf artistry and contribute to a more inclusive and innovative artistic landscape.

Networking With Creatives

Engage with a vibrant community of deaf artists and creatives at the Deaf Artists Exhibition and Meetup, fostering connections and celebrating diverse artistic expressions. This event provides a platform for deaf artists to showcase their work, offering networking opportunities with creative individuals in the deaf community.

Explore a variety of art forms including painting, sculpture, photography, and more, each representing unique perspectives and experiences. Connect with talented deaf artists, gaining insight into their creative processes and inspirations.

Join like-minded individuals passionate about art and creativity in a deaf-friendly environment, where innovation and collaboration thrive. Don't miss this chance to network with creatives, exchange ideas, and be inspired by the rich tapestry of deaf artistic talent.

Sign Language Game Night

During Sign Language Game Night events, participants come together to enjoy interactive games that enhance their ASL skills and foster a sense of community. These gatherings offer a unique opportunity to practice sign language in a fun and engaging way, promoting both personal growth and social connections within the deaf community.

Here's why you should consider joining one:

- Skill Development: Engaging in games specifically designed around sign language provides a practical and enjoyable way to improve communication abilities.

- Social Interaction: These meetups create a supportive environment where deaf and hearing individuals can come together, socialize, and form lasting friendships while honing their signing skills.

- Cultural Connection: By participating in Sign Language Game Nights, attendees not only enhance their sign language proficiency but also contribute to the promotion of cultural awareness and the strengthening of community bonds.

Deaf Community Picnic and BBQ

As we gather for the Deaf Community Picnic and BBQ, we anticipate a day filled with camaraderie, laughter, and shared experiences. This event is a popular social gathering where deaf individuals come together to enjoy outdoor activities and connect with others in a welcoming environment. It's a fantastic opportunity to engage in games, activities, and savor delicious food while using American Sign Language (ASL) to communicate and bond with fellow community members.

Here's a glimpse of what you can expect at the Deaf Community Picnic and BBQ:

| Activities | Delicious Food | ASL Practice |

|---|---|---|

| Games and fun | BBQ specialties | Conversations in ASL |

| Outdoor bonding | Picnic treats | Learning new signs |

| Socializing | Delectable desserts | Connecting through ASL |

This event fosters a sense of belonging and support within the deaf community, creating lasting memories and strengthening relationships. Join us for a day of fun, connection, and celebration at the Deaf Community Picnic and BBQ!

ASL Dance Party Event

We can't wait to share with you the exciting dance styles and vibrant event locations featured at ASL Dance Party Events.

By discussing these POINTS, we aim to provide a glimpse into the diverse dance experiences and accessible venues available for the deaf and hearing community.

Let's explore how these events blend music, movement, and sign language in a dynamic social setting.

Dance Styles Featured

Incorporating American Sign Language into dance routines, ASL Dance Party events offer a unique and inclusive experience for participants of all skill levels. At these events, you can expect to find a variety of dance styles featured, enhancing the overall atmosphere and enjoyment.

- Hip-Hop: Groove to the beat with hip-hop choreographies that blend fluid movements with energetic vibes.

- Latin Dance: Spice up the dance floor with Latin rhythms like salsa, bachata, and merengue, adding a touch of passion to the party.

- Contemporary Dance: Explore creative expression through contemporary dance forms, allowing for a mix of emotions and storytelling in each movement.

Get ready to immerse yourself in a fusion of dance and sign language at these vibrant and engaging gatherings!

Event Location Details

Venturing into the heart of Houston's vibrant deaf community, the ASL Dance Party Event at the Houston Deaf Network venue promises a night filled with music, dance, and socializing in American Sign Language.

This dynamic event offers attendees the opportunity to interact with other signers, immersing themselves in the rich tapestry of deaf culture. The venue provides a welcoming and inclusive environment for the community to forge connections and create lasting memories.

ASL interpreters will be on hand to facilitate effective communication, ensuring that everyone can fully participate and engage in the festivities. Join us at this unique event where innovation meets celebration, and where the language of music and movement unites us all.

Frequently Asked Questions

Where Can I Meet Deaf Friends?

We can meet deaf friends through local social groups, events, and online platforms. Joining clubs, attending ASL coffee chats, or exploring Meetup.com are great ways to connect.

Engaging in cultural festivals and volunteering at organizations can also help build lasting friendships. By actively participating in these activities, we can create meaningful connections within the deaf community and foster a sense of belonging.

How Do I Find a Deaf Person to Date?

When looking for a deaf person to date, we can explore various avenues. Connecting online through dedicated dating websites and apps specifically designed for the deaf community can be a great starting point.

Attending deaf cultural events or workshops can also be a fantastic way to meet like-minded individuals.

Seeking referrals from friends or family members who are part of the deaf community can lead to meeting someone who appreciates and respects deaf culture.

Where Do Most Deaf Adults Live?

Most deaf adults in the United States live in metropolitan areas with vibrant deaf communities. States like California, Texas, Florida, New York, and Illinois boast significant deaf populations. Cities such as Los Angeles, Houston, Miami, New York City, and Chicago are popular among deaf individuals due to the abundance of community resources.

Accessibility to healthcare, job opportunities, and social events are key factors influencing where deaf adults choose to reside.

Is There a Dating Site for Hearing Impaired?

Yes, there's a dating site designed specifically for the hearing impaired community. It caters to individuals who are deaf, hard of hearing, or use sign language.

Users can connect with like-minded people who understand their unique communication needs. Features like video profiles, chat options, and accessibility tools enhance the user experience.

Signing up on this platform can lead to meaningful relationships and connections within the deaf community.

Conclusion

Joining Deaf meetups is a great way to connect with the community and learn from shared experiences.

Did you know that 1 in 6 adults in the United States have some degree of hearing loss?

By attending these meetups, you can access valuable resources, build relationships, and be part of a supportive and inclusive environment.

Don't miss out on the opportunity to engage with like-minded individuals and expand your knowledge of Deaf culture.

Jamie is one of the creative forces behind the words that resonate with our audience at Deaf Vibes. With a passion for storytelling and advocacy, Jamie delves into topics that matter deeply to the deaf and hard-of-hearing community. Jamie’s articles are crafted with empathy, insight, and a commitment to positive change, from exploring the latest advancements in hearing technologies to shedding light on the everyday challenges and victories of those within the community. Jamie believes in the power of shared stories to inspire action, foster understanding, and create a more inclusive world for everyone.

Living with Hearing Loss

Top Online Deaf and Hard of Hearing Credential Programs in California

Unveil the innovative and impactful online Deaf and Hard of Hearing credential programs at California State University, Fresno, shaping the future of education.

Ever wondered where to find the crème de la crème of online Deaf and Hard of Hearing credential programs in California?

Well, look no further as we uncover the key players in this educational realm.

From the innovative approaches at California State University, Fresno, to the unique bilingual/bicultural emphasis and support for individualized programs, these programs are shaping the future of Deaf Education.

Stay tuned to discover how these programs are making a significant impact in the field and paving the way for a more inclusive educational landscape.

Key Takeaways

- Online programs at CSU Fresno offer specialized training in Deaf Education with emphasis on bilingual/bicultural approaches.

- Career opportunities include roles as special education teachers supporting DHH students in language and communication skills.

- Programs prioritize ASL proficiency, providing a holistic approach to Deaf Education in inclusive settings.

- Generous education grants totaling $1.25 million over 5 years support 55 graduate scholars in California.

Deaf Education Graduate Program

We're excited to introduce the Deaf Education Graduate Program at CSU Fresno, a 36-unit online program accredited by the Council on Education of the Deaf. This program is tailored for individuals passionate about Deaf Education and supporting Deaf/Hard of Hearing students. The emphasis on a bilingual/bicultural approach sets us apart, ensuring graduates are equipped with the necessary skills to excel in this field.

Students admitted to our program from Fall 2020 onwards will delve into a comprehensive curriculum focusing on Deaf Education. Through our partnership with the Kremen School of Education, we encourage students to pursue a master's degree along with a teaching credential, paving the way for a fulfilling career in this specialized area. Communication competence in American Sign Language is a core requirement, underlining our commitment to preparing educators who can effectively connect with Deaf/Hard of Hearing individuals.

With distinguished faculty members like Ellen Schneiderman and Rachel Friedman Narr, who are experts in Deaf Education, students receive unparalleled support and guidance, setting them up for success in the dynamic field of Deaf Education.

Deaf & Hard of Hearing Credential

As we consider the Deaf & Hard of Hearing Credential program in California, it's essential to understand the training requirements and the career opportunities it offers.

This specialized program equips educators with the skills needed to support students with hearing impairments through coursework in American Sign Language and Deaf Education.

Graduates can pursue a Preliminary or Clear Teaching Credential in Deaf/Hard of Hearing, opening doors to impactful careers in the field.

Training Requirements

During the Deaf and Hard of Hearing (DHH) Credential program in California, educators undergo specialized training that includes coursework in DHH specialization, ASL proficiency, and subject matter qualifications. Candidates are required to complete internships or student teaching to gain practical experience working with DHH students.

The program emphasizes bilingual/bicultural approaches and individualized placement strategies tailored to the needs of DHH learners. Successful completion of the training leads to the attainment of a Preliminary DHH Credential in California.

This comprehensive preparation equips educators with the necessary skills and knowledge to support DHH students effectively in educational settings. The emphasis on ASL proficiency ensures that educators can communicate fluently with their students, fostering a more inclusive and supportive learning environment.

Career Opportunities

Exploring career opportunities with a Deaf and Hard of Hearing Credential opens doors to impactful roles as special education teachers in various educational settings. With this credential, individuals can work in inclusive classrooms, resource specialist programs, or designated DHH programs.

The ability to support DHH students in developing language and communication skills, academic achievement, and social integration is key to these roles. Professionals with this credential may find themselves collaborating with speech-language pathologists, audiologists, and other specialists to create comprehensive educational plans for DHH students.

Working in both public and private educational settings allows for a diverse range of experiences and the chance to make a significant difference in the lives of students with unique needs.

Special Education: Deaf & Hard of Hearing

When it comes to special education for the Deaf and Hard of Hearing, we focus on teaching communication strategies and implementing adaptive technology to enhance learning experiences.

These approaches help bridge the gap and create a supportive environment for students facing hearing challenges.

Teaching Communication Strategies

In preparing educators for working with students who are deaf and hard of hearing, our program prioritizes the development of tailored communication strategies that promote inclusive environments and support individual needs effectively.

- Sign Language Proficiency: Emphasis on mastering sign language to enhance communication.

- Adaptive Communication Skills: Teaching various strategies to address diverse communication needs.

- Inclusive Environment Creation: Focusing on building environments that support all students.

- Individualized Support: Providing personalized assistance to meet specific student requirements.

Through specialized coursework in communication approaches and assistive technologies, our graduates are well-equipped to teach and empower students with hearing loss effectively. Our commitment to innovative teaching methods ensures that educators can make a meaningful difference in the lives of students with hearing impairments.

Implementing Adaptive Technology

Implementing adaptive technology for students in Special Education who are Deaf and Hard of Hearing involves integrating tools like FM systems, cochlear implants, and captioning services to enhance communication and accessibility. As specialists in this field, we understand the crucial role adaptive technology plays in facilitating language development and academic success for DHH learners.

These innovative tools not only improve speech perception but also create a more inclusive learning environment. Educators and students require specialized training and ongoing support to effectively utilize adaptive technology in educational settings.

Preliminary Education Specialist Credential

Throughout the Preliminary Education Specialist Credential program in Deaf/Hard of Hearing in California, candidates engage in a comprehensive 49-unit curriculum aimed at equipping them with the necessary skills and knowledge for supporting students with hearing impairments. The program includes supervised fieldwork practica and a requirement to pass the American Sign Language Proficiency Interview, ensuring educators are proficient in sign language to effectively communicate with hard of hearing students.

- Focused Curriculum: The 49-unit program covers a wide range of topics essential for understanding and addressing the needs of students with hearing impairments.

- Hands-On Experience: Candidates gain practical experience through supervised fieldwork practica, applying their learning in real-world educational settings.

- ASL Proficiency: Passing the ASL Proficiency Interview is a crucial component, ensuring educators have the necessary language skills to interact effectively with hard of hearing students.

- Comprehensive Assessment: The program evaluates candidates based on specific criteria to ensure they meet the standards required to support students with hearing impairments effectively.

Education Specialist Credential Program

The Education Specialist Credential Program at California State University, Fresno equips aspiring educators with specialized training to support Deaf and Hard of Hearing (DHH) students. This program offers a comprehensive curriculum that combines Special Education coursework with a focus on Deaf/Hard of Hearing specialization, ensuring teachers are well-prepared to cater to the unique needs of this student population.

Students in the program have the option to choose between a Traditional Program or an Intern Program, allowing them to tailor their learning experience based on their current teaching status and career objectives. To successfully complete the program, students must fulfill specific course requirements, engage in fieldwork experiences, and demonstrate proficiency in American Sign Language through the ASL Proficiency Interview.

Graduates of this program earn a Preliminary Education Specialist Credential in Deaf/Hard of Hearing, qualifying them to work effectively with students who have hearing loss. The Education Specialist Credential Program at California State University, Fresno stands out as a valuable resource for teachers of Deaf and Hard of Hearing students, providing them with the necessary tools and knowledge for success in the field.

Deaf Studies Department

As educators aiming to enhance our understanding and practice in supporting Deaf and Hard of Hearing students, exploring the offerings of the Deaf Studies Department opens up valuable opportunities for specialized learning and growth. The Deaf Studies Department offers a 36-unit online Deaf Education program accredited by the Council on Education of the Deaf, focusing on bilingual/bicultural approaches and ASL proficiency.

Here are some key highlights of the program:

- Two enrollment options are available: DHH Student Teaching Option and DHH Intern Credential Option.

- The program includes specific CSDS courses tailored to Deaf Education.

- Completion of a teaching credential is encouraged through a partnership with the Kremen School of Education.

- Expert faculty members like Ellen Schneiderman and Rachel Friedman Narr provide support and expertise in Deaf Education, enriching the learning experience for students seeking to enhance their ASL proficiency and teaching skills.

Program Philosophy Overview

Highlighting the core principles guiding our program philosophy, we emphasize a holistic approach centered on fostering bilingual/bicultural education for Deaf and Hard of Hearing individuals. Our program is designed to cater to the unique needs of each student, offering individualized placement and programs to ensure their success. We advocate for a continuum of service options to address the diverse requirements within the Deaf and Hard of Hearing community. Communication is at the heart of our program, with a strong emphasis on American Sign Language competence for all participants. By promoting an understanding of various communication and educational approaches in the field, we strive to create a comprehensive educational experience for our students.

| Program Philosophy Highlights |

|---|

| Bilingual/Bicultural Education |

| Individualized Placement and Programs |

| Continuum of Service Options |

Our commitment to excellence in Deaf and Hard of Hearing education drives us to provide innovative and inclusive learning opportunities that empower our students to thrive.

American Sign Language Proficiency

When it comes to American Sign Language Proficiency, understanding ASL Skill Assessment and Signing Proficiency Levels is crucial.

These aspects help us determine our proficiency in ASL and guide us in reaching higher levels of fluency.

Mastering these skills is essential for success in Deaf and Hard of Hearing Credential programs.

ASL Skill Assessment

Completing the ASL Skill Assessment is a crucial step for individuals pursuing the Deaf and Hard of Hearing Credential programs in California. The assessment evaluates proficiency in American Sign Language, adapted from the Language Proficiency Interview for ASL. Conducted through an interview format, it assesses knowledge and skills in ASL, helping determine language proficiency specifically in ASL.

Here are some key points to consider:

- Evaluation of ASL proficiency

- Adapted from the Language Proficiency Interview for ASL

- Conducted through an interview format

- Determines language proficiency specifically in ASL

This assessment is a vital component for those aiming to excel in the Deaf and Hard of Hearing Credential programs in California.

Signing Proficiency Levels

Assessing one's American Sign Language proficiency level is crucial for determining competency and eligibility for various programs and certifications.

The American Sign Language Proficiency Interview (ASLPI) serves as a standardized assessment tool specifically designed to evaluate signing proficiency. This evaluation method examines an individual's ability to comprehend and utilize American Sign Language effectively, focusing on linguistic aspects such as vocabulary, grammar, and fluency.

ASLPI scores range from 0 to 5, with 0 indicating a lack of signing ability and 5 reflecting a level of proficiency similar to that of a native signer. These results play a vital role in determining an individual's competency in ASL, influencing their access to specific programs or certifications related to hearing loss and signing proficiency.

Education Grant Information

Contribute to your educational journey by exploring the Education Grant available for Deaf and Hard of Hearing credential programs in California. The Education Grant for Deaf and Hard of Hearing Credential programs in California amounts to $1.25 million over 5 years, funded by the U.S. Department of Education to support 55 graduate scholars with tuition assistance and curriculum enhancement.

Here are some key points about the grant:

- The grant aims to provide financial support for students pursuing their credentials in the field of Deaf and Hard of Hearing education.

- It assists in covering tuition costs and improving the educational experience for graduate scholars in the program.

- This grant is a significant source of financial aid for students in California seeking credentials in Deaf and Hard of Hearing education.

- It offers an opportunity for students to focus on their studies without the added financial burden, enhancing their learning experience and future opportunities in the field.

Program Requirements Details

As prospective scholars, understanding the specific requirements for the Traditional and Intern Programs is crucial for navigating the path towards a teaching credential in Deaf and Hard of Hearing (DHH) education. The Traditional Program necessitates 49 units for completion, while the Intern Program requires 52 units to fulfill the credential requirements. Additionally, passage of the American Sign Language Proficiency Interview is mandatory for both programs. In the Traditional Program, there are 120 hours of preservice preparation included, offering a comprehensive foundation for aspiring educators. On the other hand, the Intern Program involves a minimum of 6 units per semester for on-the-job teachers, providing hands-on experience alongside coursework.

| Program | Required Units | ASL Proficiency | Preservice Preparation |

|---|---|---|---|

| Traditional Program | 49 units | Required | 120 hours |

| Intern Program | 52 units | Required | N/A |

Program Learning Outcomes

In our program, we focus on equipping students with the essential skills and knowledge needed to excel in teaching and supporting deaf and hard of hearing individuals. Our program learning outcomes include:

- Graduates demonstrate proficiency in American Sign Language and specialized instructional strategies for deaf and hard of hearing students.

- Students acquire the necessary skills to assess, plan, and implement individualized educational programs for students with hearing loss.

- Program participants develop a deep understanding of deaf culture, language development, and educational approaches for diverse learners.

- Graduates are prepared to promote inclusive practices, advocate for students, and collaborate effectively with families and educational teams.

Frequently Asked Questions

What Are the 2 Deaf Schools in California?

Sure!

There are two deaf schools in California: California School for the Deaf, Fremont (CSDF) and California School for the Deaf, Riverside (CSDR). Both schools provide educational programs for Deaf and Hard of Hearing students from preschool through high school. They focus on a bilingual approach to education, emphasizing American Sign Language (ASL) and English proficiency.

CSDF, established in 1860, is one of the oldest public schools for Deaf students in the U.S. CSDR offers a comprehensive educational experience tailored to the unique needs of Deaf and Hard of Hearing students.

What Is the Best School for the Hearing Impaired?

When looking for the best school for the hearing impaired, it's crucial to consider programs that offer comprehensive support and a focus on individualized learning.

California State University, Fresno stands out for its accredited Deaf Education program, emphasizing a bilingual/bicultural approach and communicative competence in American Sign Language.

Their faculty members provide expertise and encourage professional involvement, ensuring a well-rounded education for students.

Are There Online Teaching Credential Programs in California?

Yes, there are online teaching credential programs in California. These programs offer flexibility and convenience for aspiring educators. They provide training and virtual practicum experiences to prepare us for working with diverse student populations.

Graduates from accredited online programs meet the qualifications for obtaining teaching credentials. Pursuing an online teaching credential in California allows us to balance our education with other commitments while preparing for a rewarding career in education.

What Is the Most Popular Deaf School?

The most popular deaf school is the California School for the Deaf (CSD), with campuses in Fremont and Riverside. Known for its comprehensive programs from preschool to high school, CSD focuses on a bilingual/bicultural approach using American Sign Language (ASL) and English.

One fascinating statistic is CSD's long history of providing specialized services and experienced faculty, making it a top choice for deaf and hard of hearing education in California.

Conclusion

In conclusion, the online Deaf Education program at California State University, Fresno offers a comprehensive and accredited education for those seeking to work with Deaf and Hard of Hearing students.

One example of success is Sarah, who graduated from the program and now works as a Deaf Education teacher, making a positive impact in the lives of her students every day.

With a focus on bilingual/bicultural education and individualized support, this program prepares educators to make a difference in the lives of Deaf and Hard of Hearing individuals.

Jamie is one of the creative forces behind the words that resonate with our audience at Deaf Vibes. With a passion for storytelling and advocacy, Jamie delves into topics that matter deeply to the deaf and hard-of-hearing community. Jamie’s articles are crafted with empathy, insight, and a commitment to positive change, from exploring the latest advancements in hearing technologies to shedding light on the everyday challenges and victories of those within the community. Jamie believes in the power of shared stories to inspire action, foster understanding, and create a more inclusive world for everyone.

-

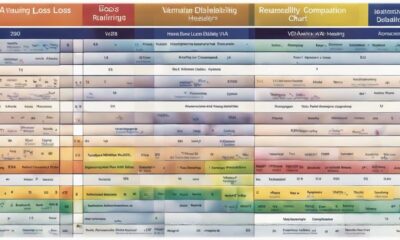

Navigating the VA System2 months ago

Navigating the VA System2 months agoVA Hearing Loss Rating Chart: Understanding Disability Compensation

-

Therapies and Interventions3 weeks ago

Therapies and Interventions3 weeks ago10 Auditory Processing Goals for Effective Speech Therapy

-

Vetted2 months ago

Vetted2 months ago15 Best Oticon Hearing Aids to Improve Your Hearing in 2024

-

Tinnitus2 months ago

Tinnitus2 months agoVA's Rating System for Tinnitus and Hearing Loss Explained

-

Navigating the VA System1 month ago

Navigating the VA System1 month agoUnderstanding Bilateral Hearing Loss VA Rating Criteria

-

Sign Language2 weeks ago

Sign Language2 weeks agoMastering the Art of Signing Letters in Sign Language

-

Sign Language3 weeks ago

Sign Language3 weeks agoSign Language Emoji Translator: How to Communicate With Gestures

-

Sign Language3 months ago

Sign Language3 months agoMedical Sign Language PDF: A Comprehensive How-To Guide